OneBlinc

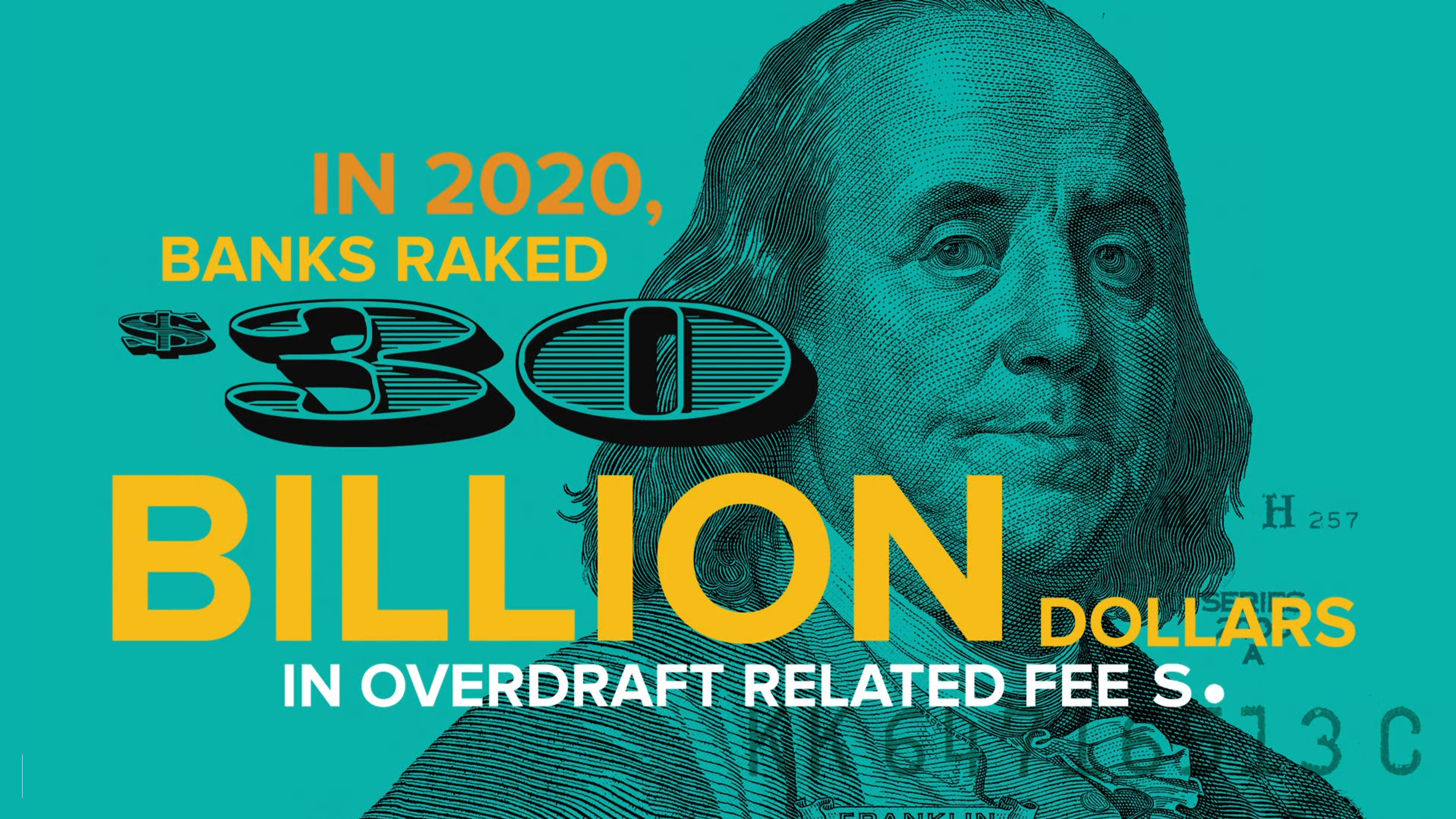

Innovators and game-changers, OneBlinc was founded to disrupt the status quo in consumer finance. Our mission is to bring about lasting positive change by offering fair financing options to all US households, especially those underserved by America's broken financial system. We don’t believe in credit scores or underwriting myopia. We abhor how current systems provide cheap credit to those that need it the least while demanding extortive rates to those who need it the most. Here to level the playing field, OneBlinc harnesses the power of technology to provide innovative credit solutions to the credit-invisible population. In addition to straightforward loan solutions, OneBlinc offers free salary advances, credit-building opportunities, and personalized account management. Why? Because we believe financial inclusion is the best way to reduce social inequality. We help our customers break out of the vicious debt cycle by offering reasonable rates and the right tools and services. Interesting fact! By February 2022, a mere three years after opening, OneBlinc had already issued over 33,000 socially responsible loans. That's over $100,000,000 of fair credit put into circulation to help real people get back on track for good!

Origins

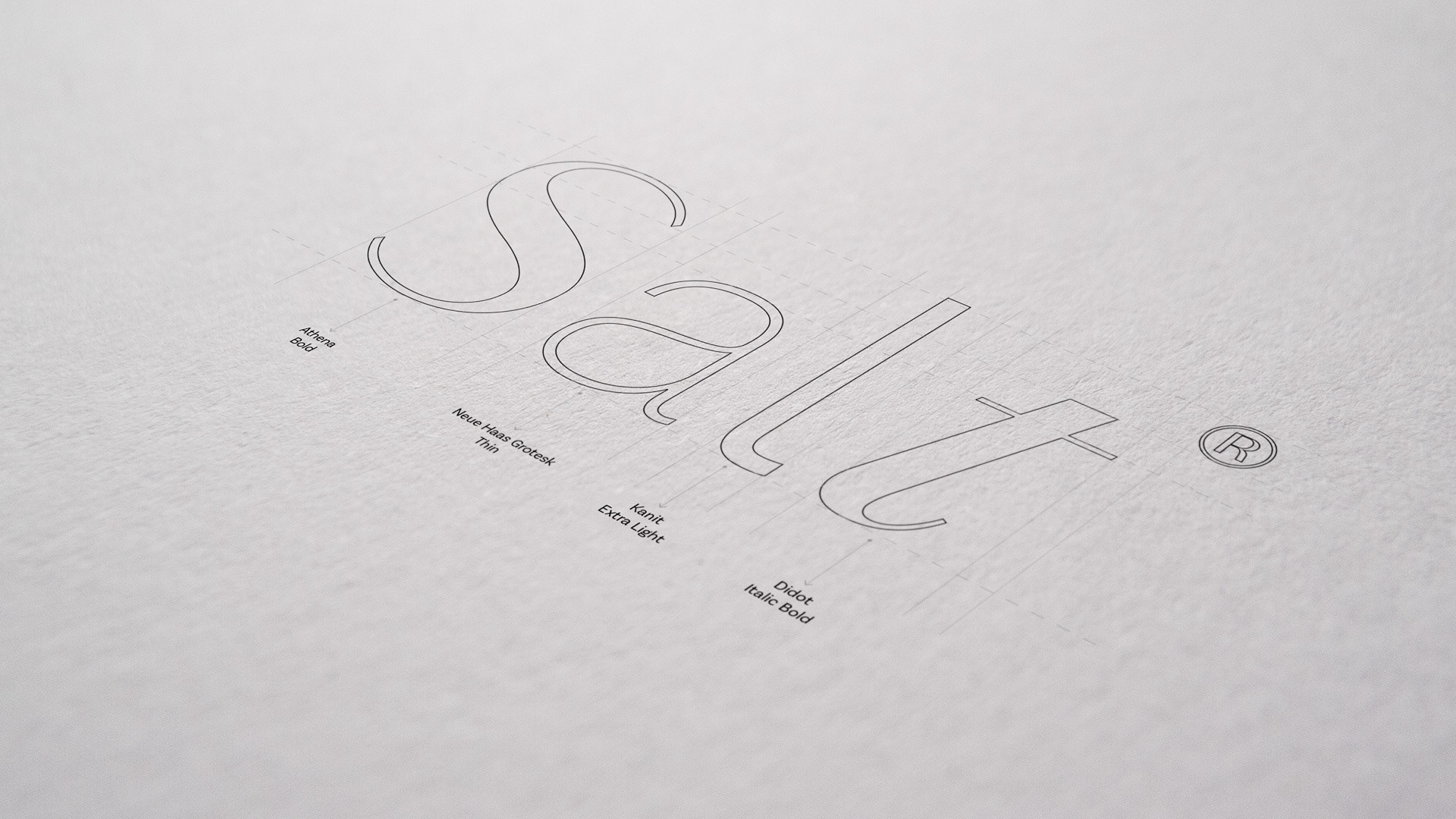

An equilateral triangle was the springboard for the OneBlinc logo. The equal sides represent OneBlinc's three pillars Functionality (fast, simple, secure), Friendliness (honest, approachable, transparent), and Commitment (to bring lasting positive change.) The rotation of the shape grants the logo a sense of movement. The triangle in motion suggests transformation, evolution, and progress.

Value

At OneBlinc, we are human-centric. Our focus is on long-term financial wellness. We provide services without patronizing or confusing our customers. Whether people know what they need from us or don’t know the first thing about finance, every word we say informs and encourages. We convey our expertise with clarity, empathy, and wit. We are plainspoken, genuine, and translators when the occasion calls for it. Only experts can make what’s difficult look easy, and it’s our job to demystify finance-speak to educate and empower.

• Quality

• Trust and Integrity

• Inclusion

• Education

• Humility

• Efficiency